Learn More

Important Facts & Sobering Stats.

Why is Having an Income When You Are Disabled Important to You?

The most valuable asset you own is not your house, car, stocks/bonds, or savings account, but rather YOUR ability to earn an income for yourself and your family, month after month and year after year.

In Canada, sadly over 3.6 million people have disabilities while in Ontario approximately 1.5 million people have disabilities. The disability rate increases with age and is expected to increase with the aging population. (Statistics Canada)

Many people purchase their own disability insurance policies on the open market. People make this choice for a number of different reasons, primarily to protect their income. Individuals who rely on disability insurance coverage provided by an employer take considerable risk because when their employment ceases, often so does their disability insurance coverage.

If You Qualify*

We believe in protecting you all the time

As a self-employed Canadian, you may acquire your own disability program and other custom-tailored benefit programs from a Landmark Canada professional, where you will receive a number of unique benefits, including coverage 24 hours per day, 365 days per year, on or off the job, anywhere in North America, with lifetime benefits available.

24

Hours per day

365

Days per year

On

The job

Off

The job

24

Hours per day

365

Days per year

On

The job

Off

The job

Watch this short video about the Blocks of Life

WSIB is on the job protection only

Where an employer is paying for part of your benefits or WSIB is involved, many Canadians have reported incidences where:

- They have been pressured to return to work, even when they felt that they weren’t ready.

- Had a doctor other than their personal physician, rather, a physician hired by the insurance company, making the final determination as to when they should return to work.

- Were pressured to participate in employer sponsored programs.

- When returning to work, were given a completely different job.

- Saw their benefits decline over time and more…

- They felt they weren’t properly covered outside of work

Why do I need protection?

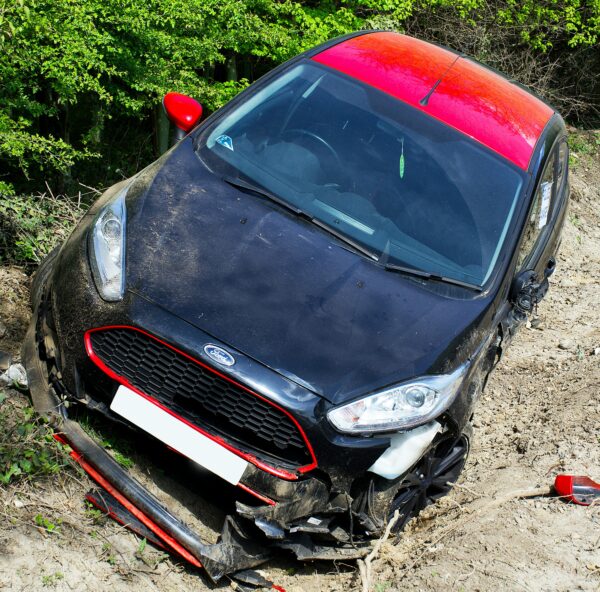

A disability – whether it’s sudden or because of an ongoing medical condition, can rob you of your ability to earn a living for yourself and your family. This program is a coverage that gives you protection against the chance of losing income if you become disabled and are not able to work to pay your expenses.

Did you know?

1 in 3 people, on average, will be disabled for 90 days or more at least once before they reach age 65? (CLHIA)

A disability can last for months, years, or even a lifetime? (CLHIA)

Our program will pay you if you are disabled and unable to work from 1st day to lifetime?

Consider these situations

- A truck driver spends six months recuperating after falling off the trailer.

- A self-employed carpenter breaks an arm while skiing and possibly can’t work for eight to ten weeks.

- A self-employed landscaper must “take it easy” after a heart attack, despite it being the busy season.

- Chemotherapy saps the energy of a busy store owner.

- A stroke seriously affects a roofer’s ability to climb ladders and finish the job, thus costing him work

There when you need us

If you are self-employed, you likely realize that you are not eligible to receive the same type of benefits like a person working in industry. Because of this, when you have a disability and you cannot work, your income can cutback or stop completely. You are unlikely to receive any Provincial aid of any kind. This isn’t safe for you and your family and it isn’t fair. Many self-employed have wondered if something could be done about this problem, because you probably have a lot of money tied up in your business and could possibly lose everything if you could not work.

Something has been done about this problem for you. A plan for self-employed people has been formed and is being made available to certain qualified, self-employed people at this time.

Invest in your future

The programs we offer have protected the incomes of hundreds of thousands of self-employed Canadian men and women. They can do the same for you. Although incomes have increased over the years, many self-employed Canadians are living on the edge and any stoppage in their income flow can devastate them and their families.

Perhaps you are currently earning a good living and your family is secure. But, what would happen if you were suddenly injured or sick and your income cut down or stopped completely? How would you continue the regular payments on your home and auto, or your family expenses? Would your family continue to be financially secure? These are questions that self-employed people must ask themselves.

A winning combination

We have the answers. We recognize that an injury or health crisis can happen at any time. We offer personal compensation plans that will provide you with money to help with these continuing expenses. Your family can continue to live their normal lives. They can retain their feeling of security.

Our government licensed sales professionals are all trained to assist you in determining the ideal coverage to suit your needs. They are able to show you an exceptional portfolio of insurance products designed specifically for the middle to high risk self-employed (or key employees) that provide comprehensive protection for all who qualify.

Our mission and focus says it all

We provide financial security by specializing in simplified personal disability insurance and financial solutions that fit the unique needs of Canada’s self-employed, skilled tradespeople, and other individuals who do not have easy access to traditional insurance and financial products.